Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income. You should issue tax invoices when you sell goods or services.

Gst Registration Online Process Documents Fees Threshold

ClearTax GST with its powerful billing vendor data mismatch reconciliation mechanism validation engines and return filing process serves as a single platform for all GST compliance.

. Penalty for delay in payment of invoice. GST to your Shopify bill. Advance paid for reverse charge supplies is also leviable to GST.

Format of the attachment. In 2020 Malaysias economy contracted by 56 per cent due to the pandemic. If you want to claim the GST on these purchases you will need a record of the.

However if you register for New Zealand GST and add your Inland Revenue Department IRD number to your Shopify store then Shopify doesnt collect GST on. For non-profit organizations its A150000 per year or more. A Complete Guide to Start A Business in Malaysia 2022.

Travel Boutique Online offers an interactive online booking interface to travel agents and tour operators allowing them to book travel products like Hotels Flights Travel Insurance Transfers Sightseeing and Holiday Packages and IRCTC simply and quickly. Malaysia has a strong educated workforce and English is widely used as a business language. An Individual will be.

Other services you will find in the interface. Alternatively you can log in using. Indias largest network for finance professionals.

Former customs director-general Subromaniam Tholasy says GST is an efficient transparent fair and business-friendly taxation system that can boost the countrys economy and provide competitiveness for its exports. Pay the correct GST and get a refund of the wrong type of GST paid earlier. You can create 100 GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format.

Uploading of ticket details is not mandatory. But there were signs of recovery in 2021 as the economy grew by 31 per cent. What is GST how it works.

It is requested to register on AI GST portal and upload ticket details within due date to get the invoices. This guide provides an overview of the key concepts of Singapores Goods. GSTR 20131 Goods and services tax.

By updating your GST number with Amazon as a Business customer you can explore lakhs of products with GST Invoices offered by Business sellers. Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in. But interest 18 on shortfall amount.

Enclose completed CP600B form to update email address if the applicant email is different from the email address that already registered with the IRB. In Australia its necessary to register GST for businesses having a gross turnaround of about A75000 or more. The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report.

Tax invoices sets out the information requirements for a tax invoice in more detail. Selling goods or services. Penalty for wrongfully charging GST rate charging.

John can claim a GST credit of 100 on his activity statement. What benefits do I get if I update my GST number with Amazon. Taxable and non-taxable sales.

Financial transactions can also be managed using our detailed reporting modules. The person making advance payment has to pay tax on. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

WHY GST IS BEING CONSIDERED AGAIN. Jpgpnggif and pdf ii. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia.

SST charged in Malaysia. Once GSTR 1 is filed invoices are sent to registered email ids captured from SSR AI GST portal and also uploaded on AI portal for download upto one year from the date of invoice. THE reintroduction of the goods.

Please check the latest updated rate from the. The Malaysian Insight file pic June 2 2022. No penalty as such.

Malaysia has a well-developed infrastructure. ITC will be reversed if not paid within 6 months. Also the amount of GST under Reverse charge is to be paid in cash only and can not be paid from ITC available.

These rates are taken on January 2020. Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. GST Plus Track everything in GST.

So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. When you buy supplies worth 50 or less its still a good idea to get a receipt. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Individual who are not citizens of Malaysia. It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the. Penalty for incorrect filing of GST return.

You can file the GST Invoices for returns through GST portal and claim input tax credit on your business purchases. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. The net result is that minimum amount of GST payable in a tax period is the amount of reverse charge in that period.

You need to keep the tax invoice for your GST records. If your store is located in Malaysia then as of October 2021 you are charged the Sales and Service Tax SST on your Shopify fees. Through mail or fax to any nearest LHDN office.

Email Your Username Password. Services Tax GST system as it relates to Singapore companies definition of GST registration requirements advantages and disadvantages of GST registration filing GST returns and schemes to. Malaysia beat out countries like Australia and the United Kingdom to claim this spot.

GST stands for Goods and Services Tax.

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Malaysia

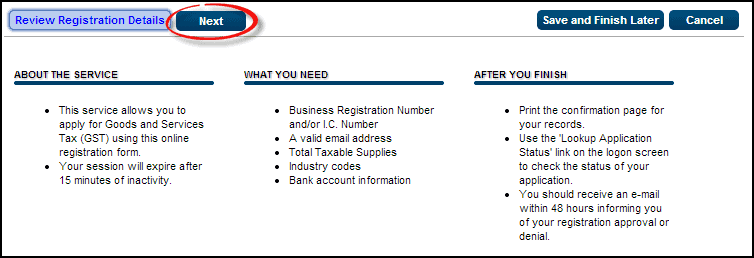

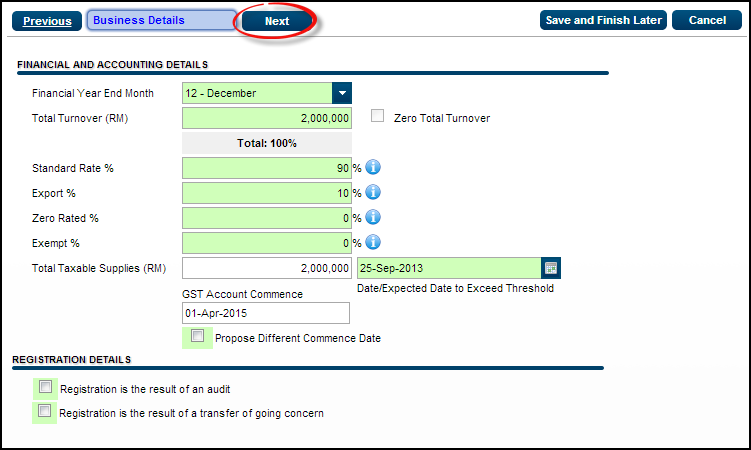

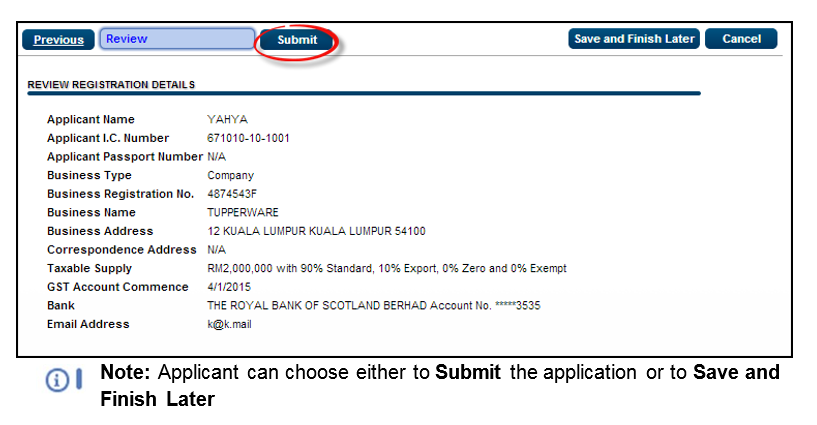

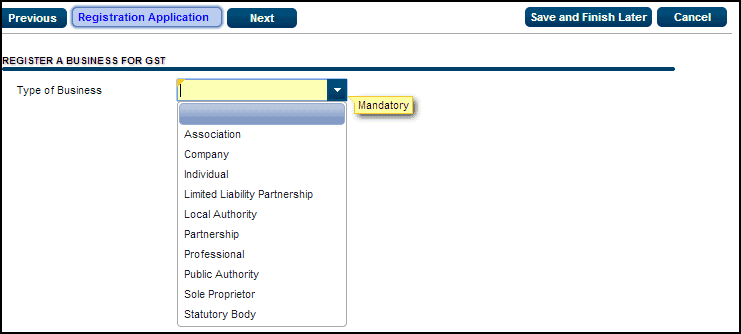

Step By Step Guide To Apply For Gst Registration

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Goods And Service Tax Gst Registration

Step By Step Guide To Apply For Gst Registration

Everything About Gst Registration Of An Llp Ebizfiling

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling

Step By Step Guide To Apply For Gst Registration

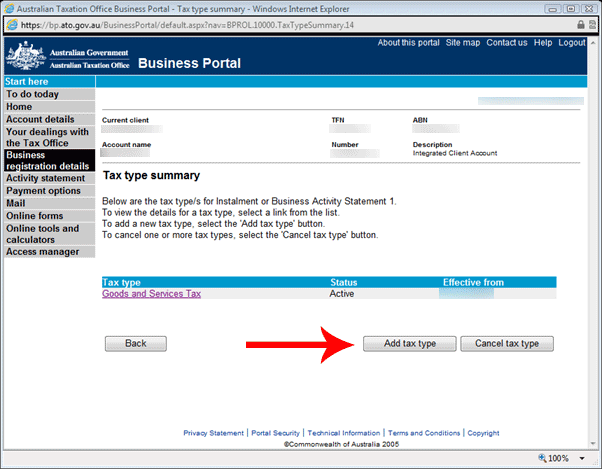

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

When Should A Business Apply For Multiple Gst Registrations All One Needs To Know Ipleaders

Kerala Hc No Cancellation Of Gst Registration In Absence Of Proper Enquiry By Gst Authority A2z Taxcorp Llp

Step By Step Guide To Apply For Gst Registration

Singapore Gst Registration Guide For Foreign Businesses Singaporelegaladvice Com

What Is Gst Process To Download Gst Registration Certificate

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Step By Step Guide To Apply For Gst Registration